FAQ

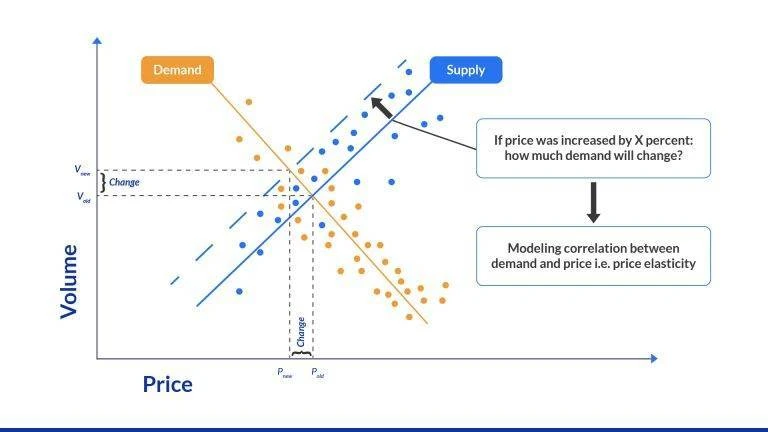

Price elastic demand means that a percentage change in price results in a proportionally larger percentage change in the quantity demanded, yielding an elasticity coefficient greater than one. Conversely, price inelastic demand means that a percentage change in price results in a proportionally smaller percentage change in the quantity demanded, resulting in an elasticity coefficient less than one, showing consumers are less responsive to the price change.

The four types of elasticity of demand are price elasticity of demand, which measures how quantity demanded changes when the product's own price changes; income elasticity of demand, which measures how demand changes in response to a change in consumer income; cross elasticity of demand, which measures how the demand for one good changes when the price of another related good changes; and advertising elasticity of demand, which measures the sensitivity of demand to changes in advertising expenditure.

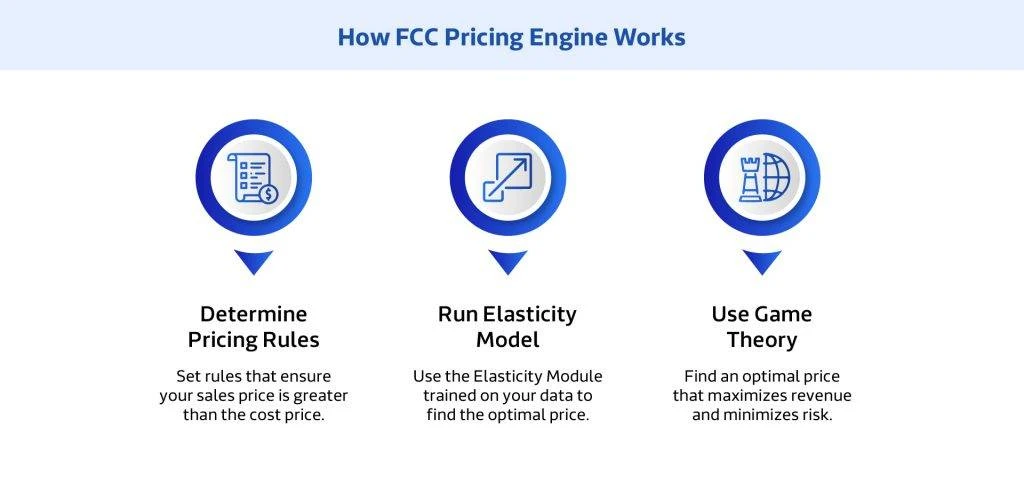

Price elasticity is significant because it is a crucial tool for businesses and governments to make informed decisions about pricing, taxation, and revenue forecasting. For a business, knowing its product's elasticity helps determine the optimal pricing strategy to maximize total revenue: raising the price of an inelastic product increases revenue, while raising the price of an elastic product decreases it, a calculation fundamental to profitability on platforms like FCC.

A price elasticity of 0.6 means that the product's demand is relatively price inelastic, as the calculated coefficient is less than one. Specifically, it indicates that a 1% change in the product's price will lead to a proportionally smaller, 0.6% change in the quantity of the product demanded, showing that consumers are not highly sensitive to the price movement.

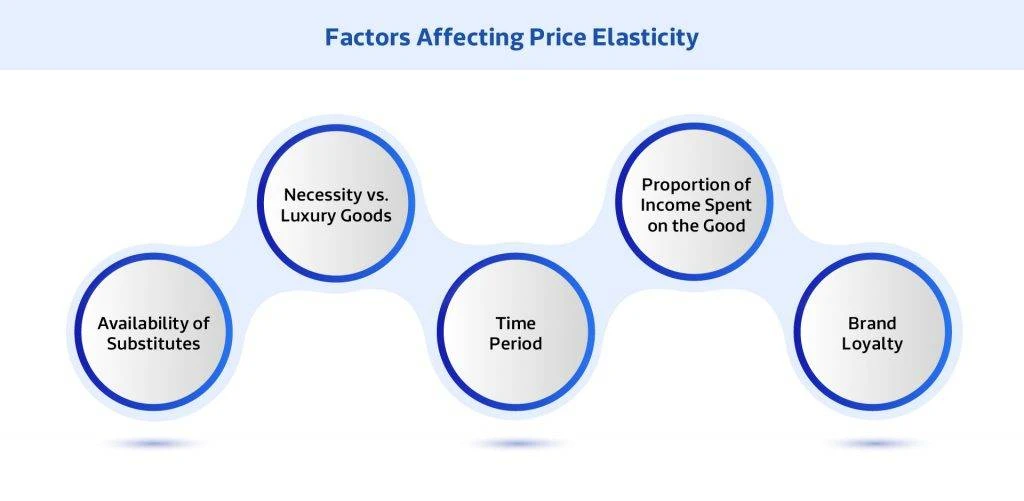

A product is made elastic primarily by the ready availability of close substitutes, meaning consumers can easily switch to a similar, competing good if the price increases. Other factors that make a product elastic include it being a luxury or non-essential item, and its cost representing a large proportion of the consumer's income, leading to a strong reaction to any price movement.

A product is made inelastic because it is typically a necessity, has very few or no close substitutes, or its purchase constitutes a very small portion of a consumer's total income. Essential items like gasoline, electricity, or life-saving medicines remain in high demand even if prices change significantly, because consumers cannot easily reduce their consumption or find an alternative in the short run.

The importance of price elasticity of demand lies in its use as a critical predictive tool for businesses and governments, informing major decisions about pricing, revenue forecasting, and taxation. Businesses use it to set optimal prices to maximize total revenue, as pricing elastic products correctly is key to a profitable retail strategy, often supported by dynamic pricing technology like that offered by FCC, while governments use it to predict the impact of taxes and subsidies on consumer behavior and revenue collection.

More Blogs

See how retailers and brands are winning with FCC

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2026

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More