FAQ

Another name for dynamic pricing is real-time pricing, and in some contexts it is also referred to as surge pricing, demand-based pricing, or time-based pricing.

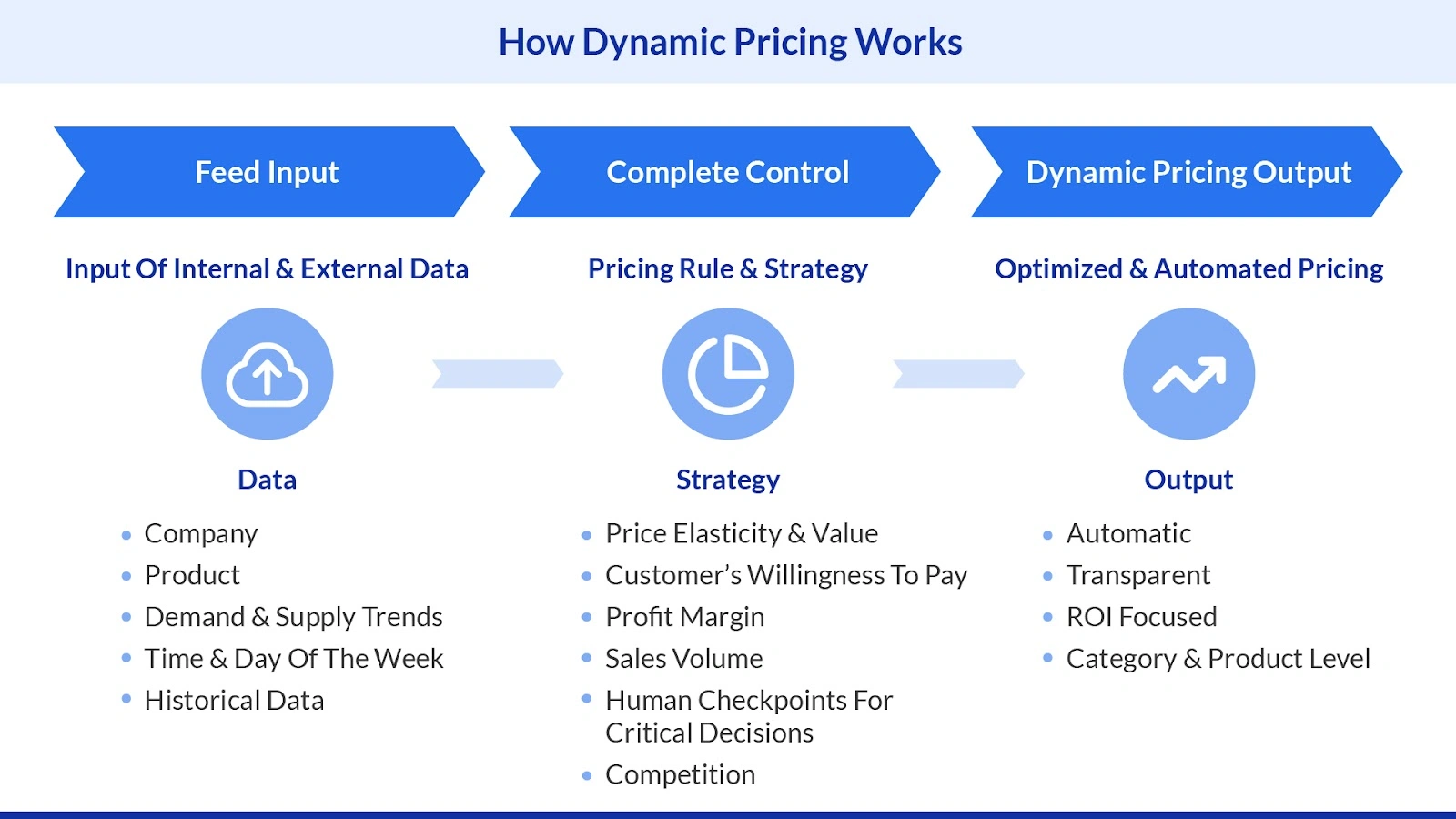

The first step in dynamic pricing is gathering and analyzing relevant data, such as historical sales, competitor prices, demand trends, and customer segments, to establish a baseline for informed and strategic price adjustments.

Dynamic pricing is used by industries such as airlines, hotels, ride-sharing services, e-commerce platforms, event ticketing companies, and utilities, all of which benefit from adjusting prices in response to fluctuating demand and market conditions.

The downside of dynamic pricing is that frequent price changes can confuse or frustrate customers, potentially harm brand trust, and require significant investment in technology and analytics to manage effectively.

The difference between dynamic pricing and price discrimination is that dynamic pricing adjusts prices for all customers based on market conditions at a given time, while price discrimination charges different prices to different customers for the same product or service based on factors like demographics or purchase history.

The difference between fixed and dynamic pricing is that fixed pricing remains constant regardless of market changes, while dynamic pricing fluctuates in response to factors such as demand, supply, and competitor actions.

The difference between variable pricing and dynamic pricing is that variable pricing changes periodically based on set conditions like season or location, whereas dynamic pricing changes continuously in real time based on live market data and demand shifts.

Dynamic pricing is not inherently considered price gouging, but it can cross into that territory if prices are raised excessively during emergencies or crises, which in many regions is regulated or prohibited by law.

More Blogs

See how retailers and brands are winning with FCC

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More

Why Retailers Should Use Pricing Comparison Engine for Growth and Better Margins?

Read More