The modern retail landscape is incredibly complex and constantly evolving. Consumer behaviors evolve rapidly, intense competition exists, and technology advances quickly, all of which necessitates that retailers stay on top of trends and have access to relevant data.

Retailers who don’t stay up-to-date on their competitors risk damaging their brand reputation and wasting resources. Uninformed retailers can run eerily similar marketing campaigns, price products incorrectly, or lose loyal customers to competitors. This is where retail competitive intelligence comes into play.

Retail competitive intelligence is no longer a luxury but an essential tool for survival in today’s market. With its powerful, 360-degree view of the market, retailers can anticipate competitor moves, identify trends before they become mainstream and craft strategies that resonate with modern consumers. Competitive intelligence provides the insights and foresight needed to remain competitive and successful in today’s dynamic marketplace.

In this article, we explore competitive intelligence in-depth along with the challenges associated and the best strategies to make the most of it.

What is retail competitive intelligence?

Retail Competitive Intelligence refers to the process of gathering and analyzing data about competitors in the retail industry. This data can include information about competitor pricing, conversion rates, product offerings, customer reviews, new product launches, pricing strategies, and more. By collecting and analyzing this data, retail brands can gain valuable insights into their competitors’ strategies and make more informed decisions to drive their own success.

However, at its core, retail competitive intelligence is about more than just monitoring competitors. It’s a way to proactively gain an understanding of the industry, market trends, emerging technologies, and shifts in consumer behavior. CI looks outward at the entire market ecosystem – rather than inward like business intelligence – so organizations can stay ahead of the competition, better position themselves, and anticipate industry-wide changes.

Real-world applications:

- By proactively using Competitive Intelligence (CI), Netflix identified an emerging trend in global entertainment – a shift towards unique and localized content. This drove them to invest heavily in creating original series and films for streaming audiences worldwide.

- Likewise, Coca-Cola recognized the shift toward non-alcoholic, health-conscious beverages by closely monitoring the global beverage market through CI. In response, they strategically acquired brands like Honest Tea to stay ahead.

These real-world examples aptly show how competitive intelligence helps companies with foresight and agility to thrive amidst industry dynamics, and changing consumer demands.

Why is retail competitive intelligence crucial for retail businesses?

Retail competitive intelligence is a powerful tool for both physical stores and online retailers. For physical stores, it can help identify optimal store locations, improve the customer experience, and better manage inventory. For e-commerce platforms, competitive intelligence can be used to tailor digital marketing strategies, optimize website user experience, and boost customer engagement tactics.

Retail businesses might not have a data collection system

One reason why retail competitive intelligence is essential for retail businesses is that they might not have a robust data collection system in place. Without access to accurate and up-to-date data about their competitors, retailers may struggle to understand market trends and consumer preferences.

For instance, imagine a small boutique clothing store that relies on foot traffic and word-of-mouth marketing. While they may have a loyal customer base, they may not have the resources or infrastructure to collect data on their competitors. This lack of information could hinder their ability to identify emerging trends or understand the pricing strategies of their competitors.

Without competitive intelligence, retail businesses may find themselves operating in a vacuum, unaware of the changing dynamics of the market and missing out on potential opportunities for growth.

Internal data alone is not sufficient

Internal data provides invaluable insights into sales trends and product performance and can even be used for forecasting. However, it is like navigating a vast ocean with only half a map in isolation. While it tells you ‘what’ is happening within your business, it doesn’t answer ‘why’ or information on ‘what’s next.’ Internal data must be complemented with external data that provides an anticipatory view to get the full picture and proactively plan for the future.

Consider a large department store that has access to vast amounts of internal data, such as sales figures, customer demographics, and inventory levels. While this data is valuable for optimizing their own operations, it does not provide a comprehensive view of the market. Without retail competitive intelligence, they may struggle to identify new competitors entering the market or understand the strategies that their competitors are employing to attract customers.

By incorporating competitive intelligence into their decision-making process, retail businesses can gain a holistic understanding of the market, enabling them to adapt their strategies and stay ahead of the competition.

Data brings insights and real business value

In the highly competitive retail industry, having accurate data can be the difference between thriving and barely surviving. It is important to understand that a drop in sales may not always result from pricing; it could be due to shifts in consumer preferences, innovative marketing strategies from competitors, or external factors like economic downturns. Retailers should look for a long-term solution instead of relying solely on price wars to resolve declining sales. Without having access to comprehensive data, retailers risk making decisions based on guesswork rather than hard facts and insights.

Now, data in raw form can be messy and require cleaning, validation, and often reconciliation when sourced from multiple channels. But platforms like FCC’s Competitive Intelligence Solution can streamline this process, turning raw data into actionable insights. This Empowers retail businesses to drive strategic decisions and optimize operations, ultimately delivering exceptional value to their customers.

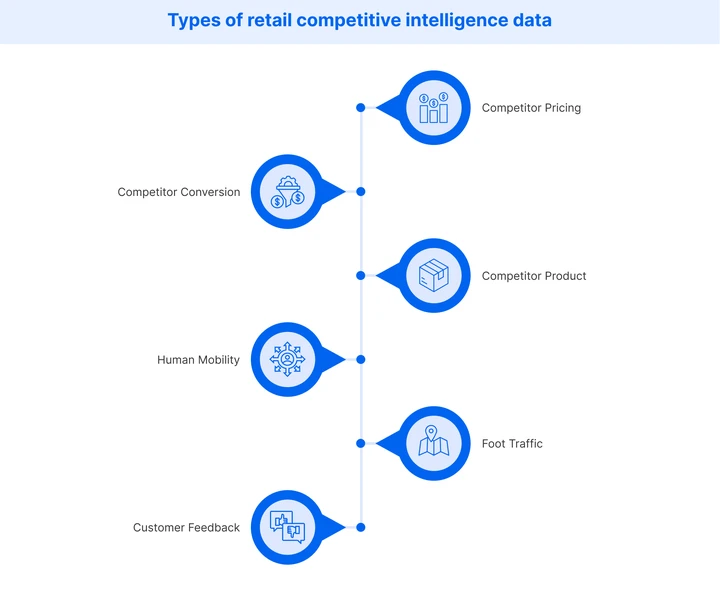

What counts as retail competitive intelligence data?

In retail, businesses must arm themselves with accurate and relevant data to succeed. Retail competitive intelligence data provides businesses with insights into their competitors’ strategies, allowing them to make informed decisions and remain a step ahead of the competition.

This data type has three major components: market share analysis, pricing research, and product comparison analysis.

Market share analysis gives insight into an industry’s total sales volumes for a given period, while pricing research involves evaluating prices in different geographical locations or channels. Product comparison analysis helps identify changes in product features and pricing trends that could impact sales figures. With this comprehensive intelligence, retailers can gain valuable insights into customer behaviors and formulate sound business.

Let’s delve deeper into the significance of each type of retail competitive intelligence data:

Competitor pricing data

A deep understanding of how competitors price their products is critical to staying competitive. This data reveals the base prices, discounts, promotions, and seasonal offers. By ethically gathering this data, businesses can gauge the market rate for products, identify gaps in pricing strategies, and adjust their own offerings to attract more customers. It’s not just about matching or beating a competitor’s prices; it’s understanding the value behind those prices that makes all the difference.

Competitor conversion data

Knowing the conversion rate of competitors can provide invaluable insight into how a business is performing. This data reveals how many visitors are converted into paying customers or leads, allowing businesses to use it for benchmarking and conducting a competitive gap analysis to identify areas in their sales funnel and customer journey where they can improve.

Competitor product data

Reaping the rewards of competitive research can provide valuable insight into industry trends and your competitors’ products. With knowledge about features, benefits, and flaws of competitors’ products, businesses can reverse engineer successful features while avoiding observed pitfalls without taking on any risk.

Human mobility data

This data provides insights into migratory trends. For instance, if a significant number of people are moving from one area to another, it can provide valuable information to inform decisions about store locations. This, combined with data on competitors’ store locations, can help identify areas of growth potential and reveal insights into their growth strategy.

Foot traffic data

Foot traffic data is a powerful tool to help brick-and-mortar stores increase their sales and profitability. It provides insight into high-traffic areas, allowing store owners to identify prime locations to maximize their sales opportunities. Additionally, businesses can use this data to compare with their competitors, helping them make informed decisions on the best locations for their stores.

Customer feedback data

Customer feedback provides invaluable insights into what resonates with customers and what competitors are doing wrong. By tapping into the raw voice of customers, retailers can identify emerging trends, address latent needs, and even forecast potential market shifts. With customer feedback incorporated into a business’s competitive intelligence strategy, businesses can get a better handle on their market space and make informed decisions.

Flipkart Commerce Cloud (FCC) has established itself as a leader in retail competitive intelligence, offering businesses a comprehensive suite of tools to stay ahead of the competition. Here’s are the types of data our retail competitive intelligence platform can gather and analyze:

Pricing data: Our online retail pricing solution helps businesses monitor competitor’s pricing strategies. We provide data on base prices, discounts, and promotions so you can adjust your own accordingly. We also provide scans to identify potential brand violations or instances where competitors might undercut branded products or violate Minimum Advertised Price (MAP) agreements. Additionally, our omnichannel pricing solution allow businesses to analyze and react to price variations across different sales channels.

Assortment and exposure data: Competitive analysis provides businesses with powerful insights to strategize a better product assortment. Detailed data can be accessed on how competitors expose or promote their products across various channels, allowing companies to analyze and identify gaps in their offerings. We also provide details into competitors’ product offerings by analyzing comprehensive data on their product features, benefits and customer feedback.

Dynamic pricing insights: Real-time data on competitor pricing can help businesses stay ahead of the curve. With our software, you can see when competitors adjust their prices in response to market dynamics, sales events, or inventory levels – giving you the insight to manage your business more effectively.

Competitor online metrics: Our platform helps you track your competitors’ online data at scale, giving you key insights into their digital strategies, customer engagement metrics, and more. This way, you can easily keep pace with their actions and stay ahead of the game.

Safeguarding Brand Integrity: Our competitive intelligence tools are instrumental in safeguarding your brand's integrity. Brands can utilize our pricing comparison software to enforce Minimum Advertised Price (MAP) policies effectively. This feature allows you to monitor pricing violations and swiftly identify unauthorized sellers on e-commerce platforms, helping you maintain a consistent brand image and protect your pricing strategy.

Our retail media solution uses proprietary algorithms that blend traditional statistical methods with advanced techniques like game theory to derive actionable insights from the collected data. We also consider external factors such as economic conditions, market trends, and seasonality to provide you with a comprehensive understanding of your competitors.

6 ways companies can use retail competitive intelligence

Help with assortment optimization

Competitive intelligence can empower retailers to boost their product offerings. It enables them to compare their product range with competitors and assess factors such as price points, brand affiliations, product quality etc. In addition, retailers can monitor market trends to see which products are being introduced or discontinued. By leveraging this intelligence, retailers can identify underserved market segments and refine their product selection.

This could involve pinpointing pivotal product categories and main competitors while assessing the evolution of key trends in the space. Ultimately, the comprehensive approach equips retailers with a panoramic view of the competitive landscape, helping them make better decisions.

Here are few examples of how retailers use competitive intelligence to proactively identify fulfillment opportunities in the market:

Pricing Strategy: Consider AOC’s pricing strategy in the computer monitor industry. While established manufacturers like ASUS and Dell dominate the higher price tiers, AOC identified the untapped low-end computer market and became the leader by offering a lower price point.

Category expansion: Walmart’s acquisition of Moosejaw, a significant player in the outdoor recreation area, is a perfect example of category expansion. This approach enabled Walmart to enter a new category ahead of the competition.

Brand exclusivity: Brand Exclusive deals with companies could serve as a big selling point for buyers. Being the exclusive supplier of a well-known brand or bringing on new products early on establishes your business as the go-to location. But it’s critical to take a cautious approach to trends, ensuring that purchases are consistent with overall brand strategy and profit margins.

Deciphering product trends

Understanding your position relative to competitors over time is foundational to effective assortment and pricing strategies. Knowledge of competitors’ product offerings, bestsellers, and pricing equips retailers to make data-driven decisions. Key trends to monitor include:

- Pricing dynamics: Combine pricing knowledge with insights into product assortment. Examine the pricing trend of items that are about to be phased out.

- Brand and category movements: To be competitive, keep up with emerging brands or categories. With assessment and early trend adoption, you can capitalize on market opportunities without taking unnecessary risks.

- Seasonal Shifts: Improve conversion rates and inventory management by evaluating competitor data with previous sales records, allowing for more exact planning and forecasting.

FCC’s retail media solution elevates retail strategy by providing retailers with data-driven insights on pricing, product assortment, and more. Utilizing real-time analysis of market trends and customer preferences, FCC allows retailers to stay ahead of the competition and make informed decisions that will drive sales.

Better understanding of competitor's pricing

Understanding the pricing strategies of competitors is essential for any business’s success. From determining their listed price to monitoring promotional offers and discounts, knowing what rivals are charging can help inform your brand’s competitive stance. By understanding competitors’ pricing tactics, businesses can determine how to strategically position their offerings in the market to attract and captivate consumers.

Knowing your competition’s pricing also gives insight into their broader marketing and positioning strategies, enabling companies to anticipate market moves before they happen. FCC’s data-driven approach helps businesses keep up with the latest market pricing dynamics. With insight into where the market is heading, businesses can craft strategies that engage their target audience and stay competitive. Learn more about our retail pricing software here.

Perform an in-depth SWOT analysis

Competitor intelligence is an invaluable resource for businesses of all sizes, providing insights into areas of both strength and vulnerability in the market. By understanding where competitors falter, businesses can tailor their offerings to fill the gaps and address existing market needs. On the other hand, recognizing competitors’ strengths helps inform decisions about which battles to pick and where to innovate.

A SWOT analysis can help businesses gain insights into their strengths, weaknesses, opportunities, and threats. By comparing competitor data with your performance metrics, you can identify areas where you have an advantage or disadvantage. This could be in pricing strategies or product assortment. It’s also important to stay current with competitors constantly changing their strategies, as they may disrupt market dynamics. Proactive strategy adjustments can help you stay ahead of the competition.

FCC helps businesses enhance their SWOT analysis by providing real-time competitor insights. From tracking pricing strategies, customer feedback to monitoring product assortments, FCC offers a comprehensive view of the competitive landscape so businesses can anticipate market shifts and stay ahead of the curve. Businesses can use these insights to refine their strategies to remain proactive and competitive in their market.

Develop revenue-driven pricing strategies

Understanding competitors’ pricing strategies, discounts, and promotions is vital to influencing a customer’s buying choices. The primary objective of merchandising is to increase traffic, conversions, and, ultimately, revenue.

Pricing intelligence tools such as FCC help retailers make informed decisions grounded in current and historical data and can answer questions such as:

- “Are my products competitively priced?”

- “What impact do competitor promotions have on my sales?”

- “Is my product range priced competitively across channels?”

- “How can I refine the timing and extent of markdowns for better inventory turnover?”

Built better discount and promotional strategies

Are you fully utilizing all available digital channels to drive business growth? Being aware of competitive actions and dynamics from a marketing perspective is key. Tracking competitor promotions is an important data point, as it allows you to see how frequently they run certain promotions and over which time periods so that you can strategize your own accordingly. Monitoring competition’s promotions also gives insight into trends, allowing you to react quickly with a promotion that attracts customers away from them.

Promotions and discounts can be an effective way to boost sales, profits, and customer satisfaction. Using competitor’s promotional data, you can gain insight into which promotions resonated with customers and which didn’t. This helps you better predict consumer behavior and tailor your promotions in a more targeted manner, leading to an improved Return on Advertising Spend (ROAS). By tracking pricing along with where and how the promotions are presented, you can create compelling offers tailored to the needs of your target customers for maximum impact.

FCC’s platform provides retailers powerful tools to gather, analyze, and act on competitor promotional data in real-time. This ensures that retailers can create targeted promotions that are competitive and resonate with their target audience, helping them stay one step ahead of the competition.

Use Competitive Intelligence for price testing

Competitive Intelligence (CI) offers a robust framework for conducting controlled experiments, especially in pricing. By analyzing the changes in your sales metrics against competitors' alterations, you can gain valuable insights into the ripple effect of each price modification. This data can be used to make informed decisions on pricing strategies and optimize profits.

For example, by analyzing how your demand shifts in response to your pricing relative to competitors, you can better understand price elasticity - a measure of how sensitive demand is to price changes. If consumers continue to choose your product even when more affordable alternatives are available, it indicates that they place a high value on the quality of your product. With this insight you can still explore price increments without affecting demand.

FCC Platform helps retailers leverage real-time competitive intelligence to run data-driven experiments and gain insights into market dynamics to ensure their pricing strategies remain competitive and profitable. With the platform, retailers can access granular data on competitors' pricing strategies, which can help them refine their models for better success.

Become a growth-first retail brand with FCC's competitive intelligence platform

Gain the edge over your competition and increase market share with FCC's competitive intelligence platform. Our AI-driven platform analyzes your competitor's strategies and allows you to fine-tune your product for maximum conversion. With FCC's competitive intelligence platforms, brands can:

- Compare competitor's products across all channels

- Monitor pricing at a customized predefined frequency

- Track competitor's promotional offerings on both online and offline channels

- Leverage competitor's data to identify selection and demand gaps

- Check pin-code level availability of competitor's product

- Perform sentiment analysis of product reviews

- Develop a deep understanding of the user's perception

Smart retailers choose FCC to get ahead in the competitive retail industry. Our tailored solutions for online, omnichannel, and brick-and-mortar retailers equip you with the tools to automate competitor benchmarking, tap into new markets, and maximize revenue opportunities. Plus, our emphasis on data foundation ensures your decisions are always based on quality insights — enabling you to focus on what you do best: growing your retail business.

To know more about how FCC can help, book a free demo with our retail expert!