A well-defined pricing strategy is the foundation of a successful retail business and directly impacts its profitability and market position. One such method widely used by many retailers is cost-plus pricing.

Cost-plus pricing is a simple strategy that generally involves adding a markup percentage to the total cost of goods and services to arrive at a final selling price. This method can help ensure profitability while factoring in all input costs into your calculations.

This blog will help you learn more about the cost-plus pricing approach, including its calculations, benefits, challenges, suitability, and alternate pricing options.

What is a Cost Plus Pricing Strategy?

Cost-plus pricing is a mark-up pricing strategy where you add a fixed percentage, known as the profit margin, to the cost of producing (or purchasing) a product or service. This calculated amount is the retail price at which your offerings will be sold to the users.

Unlike other pricing strategies that consider market demand or competitor pricing, cost-plus pricing focuses on your company’s expenses. It ensures that all costs are covered and a profit is made on every sale, providing a safety net for your business.

Retail businesses, such as apparel, grocery, and home appliances, frequently employ cost-plus pricing. In these segments, the products sold vary, allowing for different markup percentages to be applied to each item.

However, if you are working in the Software as a Service (SaaS) sector, this pricing approach may not be the most suitable. In this case, the value delivered by your products often outweighs the production costs.

Establishing Cost Leadership

Businesses aiming for cost leadership can leverage cost-plus pricing as a strategic tool. This method allows you to offer attractive prices while maintaining a satisfactory quality level, thanks to your expertise, which helps keep costs lower than those of your competitors.

As a result, this strategy helps create a compelling value proposition by positioning you as a cost leader. Low costs translate to competitive prices, which, along with superior customer value, become central to your brand identity.

To further strengthen your value proposition and build trust, cost-plus pricing can be communicated transparently. For example, you can openly share your pricing policy with a statement like, ‘Our prices will never exceed X% of our products’ cost.’ This transparency creates trust with potential customers and contributes to creating a credible and customer-centric brand.

How to Ensure a Good Markup?

Often referred to as profit, the markup is a fixed percentage that you add to the Cost of Goods Sold (COGS) to arrive at your selling price. The COGS should cover all your direct and indirect costs. When deciding on your markup, it is important to factor in the profit required to procure more raw materials for production, your revenue objectives, and the pricing of similar products by your competitors. Setting a price that is too high might deter potential customers. However, a price that is too low might result in missed profit opportunities.

Cost-Plus Pricing Formula

The simple formula for cost-plus pricing is:

Selling Price = Cost Price + (Cost Price × Profit Margin)

Let’s understand it with an example. Suppose the cost to produce a product is $40, and you want a profit margin of 30%. This cost includes your direct labor costs, material costs, and other operational costs.

Using the cost-plus pricing formula, the selling price would be:

Selling Price = $40 + ($40 × 0.30) = $52

So, you would sell the product for $ 52 to achieve a 30% profit margin.

This formula simplifies your pricing decisions by including costs and profit goals into a single calculation. It offers a transparent and systematic approach to setting retail prices for your offerings.

How to Set Up a Cost Plus Pricing Strategy?

- Calculate the Total Cost: Firstly, you need to identify the fixed (warehouse rent, insurance, or salaries) and variable components (distribution costs, marketing costs, selling costs) of your costs. Remember that fixed costs do not change with the number of units produced, whereas variable costs are directly related to the total output. Add all these costs to determine the total input cost.

- Establish the Cost Per Unit: Now, you must determine the cost per unit. For this, divide the total cost calculated above by the total output. This is your per-unit cost, which will form the basis for your final sales price.

- Determine the Profit Margin: Depending on your brand goals, determine the profit margin you wish to achieve. For instance, if you sell luxury products, you may keep a higher profit margin. On the other hand, if you sell residential cleaning supplies, you can maintain a lower profit margin to establish yourself as an affordable brand.

- Apply the Cost-Plus Pricing Formula: Use the following formula to calculate the selling price for one unit.

Selling Price = Cost Price + (Cost Price × Profit Margin)

This method will help ensure that all costs are covered and a profit is made on every unit sold.

- Review and Adjust: Regularly review and adjust your pricing strategy based on changes in costs and evolving market conditions. You may also undertake a basic competitor analysis to get an idea about the prevailing profit margin in your domain. This approach helps keep your retail pricing strategy relevant and effective.

Examples of Cost Plus Pricing Strategy

There are many examples of businesses using cost-plus pricing strategies, two of which are Everlane and Costco

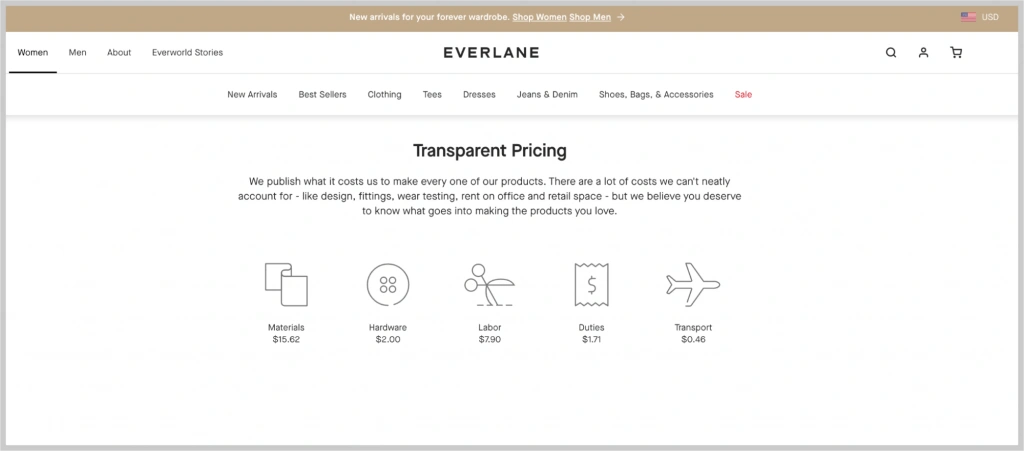

Everlane: Transparency in Pricing

Everlane, a clothing company, has built its brand on the principle of ‘radical transparency’. They disclose the cost of making each garment and their profit, applying a markup of 2-3 times the cost of production. This is lower than the industry average of 5-6 times, giving them a competitive edge while avoiding overpricing. For every piece of garment, they show a breakdown as shown below:

Credit: Everlane Website

Costco: Cost-Plus Pricing for Value

Costco, a membership-based wholesale retailer, reportedly limits product markups to around 14% (or 15% for its own brand products). It allows Costco to offer high-quality products at discounted prices, attracting customers seeking both value and convenience.

This strategy gives the company an average profit margin of just 2%, but it works because Costco sells products in bulk, increasing the average order size. Customers know they can find great deals at Costco.

Benefits of Cost Plus Pricing

Cost plus pricing offers various advantages that can make it a good pricing method for your retail business:

Predictability and Simplicity

A cost-plus strategy offers predictability as you can easily analyze past sales data to estimate your expected revenue for the current period. You need not undertake elaborate external research. Rather, you just need to analyze your production costs and determine a markup to make pricing decisions.

Justifiable Pricing

Cost-plus pricing facilitates clear communication with consumers about price changes. For instance, if you need to increase the retail price of a product due to an increase in production costs, the hike can be easily explained and justified to the consumers.

Consistent Returns

If you calculate correctly, this method will cover all your fixed and variable costs. This would allow you to avoid instances of accidentally setting low prices and help ensure steady returns due to a fixed markup percentage.

Challenges with the Cost-Plus Approach

While cost-plus pricing can be a safe and predictable strategy, it is not without its challenges:

Ignoring Market Dynamics

Cost-plus pricing is an inward-looking approach that might overlook external risks like market changes and competitor pricing. This could lead to your products being priced too high or too low, potentially impacting your sales and profits. Moreover, as your customers’ needs and the market dynamics evolve, your pricing strategy should adapt accordingly. If you predict high sales volumes and opt for a low markup, but sales are below your expectations, you may end up not covering your costs.

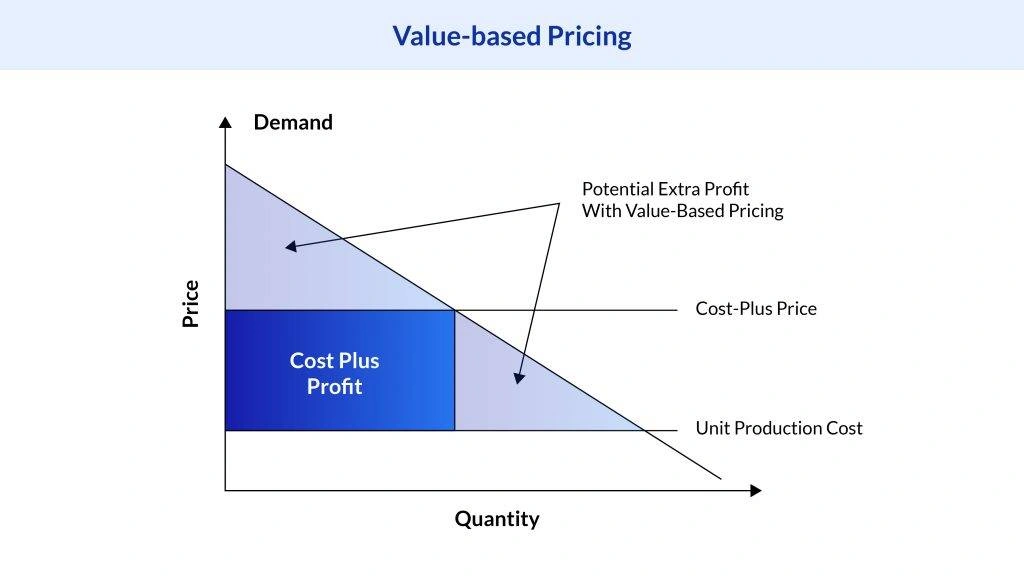

Overemphasis on Costs

This strategy focuses on costs rather than the value perceived by customers. If customers see high value in your product, you might miss out on potential profit by not pricing accordingly. Remember, customers are more interested in the value your product brings to them than your costs or profit margin. In such situations, value-based pricing can be a better strategy as the price is set based on its perceived value to the customer rather than the cost of production.

Need for Accurate Cost Calculations

Cost-plus pricing requires precise cost calculations. Any oversight in factoring in every cost, from R&D to after-sales services, could lead to under- or over-pricing. Also, if costs increase suddenly, you might end up absorbing those extra costs in the margin until you can update your pricing.

Unsuitability for Highly Competitive Markets

In markets where price wars are common or products have a higher price sensitivity, cost-plus pricing may not be the most effective strategy. Your unit cost might not be competitive, and without considering competitor prices, you could lose sales and market share.

Who Should Consider a Cost Plus Strategy?

Cost plus pricing can be a viable strategy for certain types of businesses:

Businesses with Stable and Predictable Costs

If your business has a stable cost structure with predictable expenses, cost-plus pricing can be an effective strategy. This method is popular with small enterprises that lack the resources to undertake extensive customer and market research.

Companies in Less Competitive Markets or with Unique Products

This method is useful when you operate in a market with less competition or if your products are unique. Cost-plus pricing can help you maintain profitability while building trust and loyalty with customers through transparency in pricing.

However, while cost-plus pricing can work well for some businesses, it is not always the best fit. For example, a Software as a Service (SaaS) provider might find that their products provide significantly more value to customers than the cost to produce them. In such cases, the following strategies can yield higher profits:

- A value-based strategy that focuses on the willingness of the customer to pay.

- A tiered pricing model offering predefined bundles of features at various price points.

Alternative Pricing Strategies

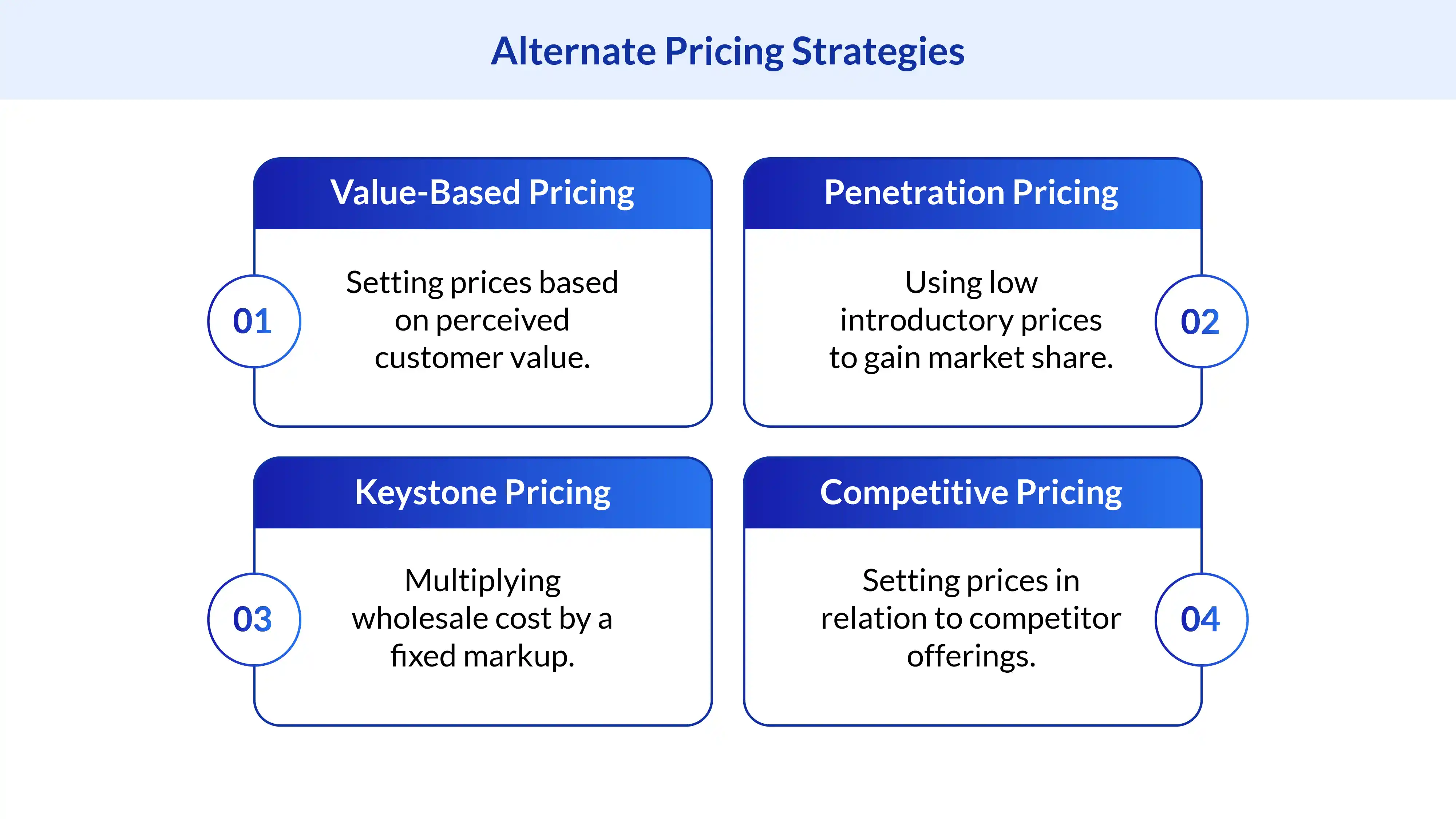

While cost-plus pricing is a reliable strategy, it is not the only pricing strategy available. Here are some alternative pricing methods that you can consider for your retail business:

Value-Based Pricing

It is a customer-centric method that sets prices depending on the value of a product or service that the customer perceives. This strategy goes beyond costs or competitor pricing and is most commonly used by niche industries and those that provide customer-oriented unique products. Value-based pricing is effective for businesses with unique or highly valuable products or services.

Penetration Pricing

Penetration pricing is a strategy used by retailers to quickly secure a significant market share by setting low prices initially to encourage more customers to purchase the product or service. This method is typically used by new retail companies in competitive markets. An aggressive form of this strategy is known as predatory pricing, which sets the price at such low levels that other companies cannot compete.

Here are the key features of penetration pricing:

- Rapid Market Entry: Penetration pricing uses low introductory prices to quickly gain new customers and establish a foothold in the market. By offering a lower price point, retailers can encourage users to try a new product or service they might otherwise hesitate with.

- Disrupting Competition: Low introductory prices under this strategy can put pressure on competitors. This can force them to either lower their prices or improve their offerings to retain customers.

Keystone Pricing

Keystone pricing is a popular approach in both retail and e-commerce. It sets the retail price of a product at double its cost. Retailers can use this as an initial reference point and then modify the retail price based on various factors, such as market conditions and competition. This enables retailers to stay competitive while maintaining a sizeable profit margin.

Here are the key features of keystone pricing:

- Determining Optimal Prices: By pricing their products at double the cost, online retailers can guarantee a profit on each transaction, even when offering competitive prices. This can draw customers and boost sales, as consumers are likely to purchase products which they deem fairly priced.

- Ease of Calculation: It offers ease of calculation and application across a broad spectrum of products. Retailers can employ this pricing strategy to efficiently price multiple products without dedicating considerable time to each individual product.

Competitive Pricing

- Market Benchmarking: Competitive pricing allows retailers to analyze how their products or services compare to other sellers in terms of price. This helps ensure that the prices offered align with customer expectations of value, maximizing sales without reducing profits.

- Dynamic Process: Under competitive pricing, product prices can change based on updates in competitors’ pricing strategies. This makes this strategy a dynamic and responsive approach suitable for competitive retail segments like fashion and snacks.

Top Considerations for Cost-Plus Pricing

When implementing a cost-plus pricing strategy, here are some of the important factors that you must consider:

- Accurate Cost Calculation: It's crucial to calculate all costs accurately, including direct, indirect, and overhead costs. Any oversight in cost calculation could lead to under- or over-pricing.

- Regular Review and Adjustment: Market conditions and costs can change over time. To ensure profitability, you must regularly review and adjust your prices based on these changes.

- Customer Perception and Demand: The impact of cost-plus pricing on customer perception and demand should not be overlooked. Pricing can influence how customers perceive your brand and their willingness to purchase.

- Profit Margin: Ensuring that the desired profit margin is adequate to cover all expenses and generate a profit is vital. If the margin is too low, you might not cover all costs, and if it is too high, you could price yourself out of the market.

- Elastic Demand: The concept of elastic demand, where the product's demand changes with its price, is crucial in pricing strategies. If you are using cost-plus pricing, it is beneficial to apply it to products with low price sensitivity. For example, fast-fashion clothing has low elastic demand as customers can easily switch brands due to minor price changes.

Is Cost Plus Pricing Right For You?

Deciding if cost-plus pricing is the right strategy for your business involves considering your business's goals, market conditions, and the unique characteristics of your products or services. It is not a one-size-fits-all solution, and it's crucial to choose a pricing strategy that aligns with your specific business needs.

If you're looking for robust technology solutions to help you make informed pricing decisions, consider Flipkart Commerce Cloud (FCC). With a suite of powerful tools, FCC Pricing Manager can assist you with optimizing the pricing strategy and growing your business.

With FCC’s pricing manager module, you can

- Get a 360-degree market view with historical and real-time data on competition, external and internal factors

- Align your pricing recommendation with your business KPIs such as Margin, turnover, profit maximization, and inventory optimizations

- Define price elasticity to predict whether the price will be accepted and stimulate output based on business scenarios to optimize strategy

- Facilitates real-time price adjustments in response to evolving market conditions and ensures accurate product pricing at all times

Need help with your retail pricing strategy? Talk to our experts today.