Imagine you’re browsing an online store, contemplating the purchase of a high-end smartphone. You’ve been eyeing it for a while, but today, as you check the price, you notice something interesting – it’s slightly lower than it was yesterday. Curious, you refresh the page a few times, and with that, the price keeps fluctuating. This real-time price adjustment, known as dynamic pricing, is driven by a sophisticated algorithm that adapts to market conditions and customer behavior, among other factors. In this blog post, we take a closer look at dynamic pricing algorithms and how they work. Read along!

Also, don’t forget to read our previous blog on dynamic pricing here: Ultimate Guide To Dynamic Pricing Strategy In 2025

What is algorithmic pricing?

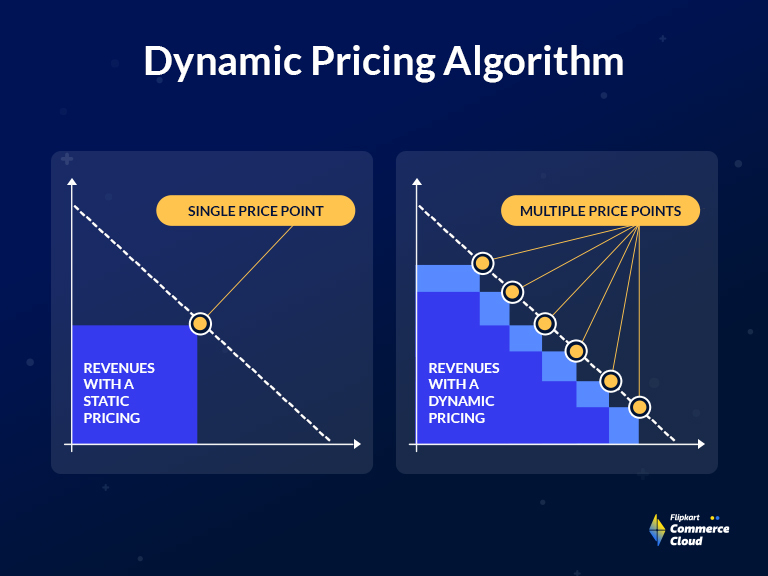

Algorithmic pricing is a dynamic and data-driven approach to setting revenue-optimal prices for products or services. Unlike traditional fixed pricing, where prices remain static regardless of market fluctuations, algorithmic pricing refers to the practice of using advanced mathematical models and data analysis to determine the optimal price at any given moment.

This method takes into account various variables such as supply and demand, competition, customer behavior, and even external factors like weather conditions. The goal? To maximize profitability while gaining a competitive advantage and remaining responsive to market changes.

Algorithmic pricing is not a one-size-fits-all solution. Instead, it tailors pricing strategies to align with business objectives, offering flexibility and adaptability that traditional pricing models simply can’t match. Learn more about the most used retail pricing strategies by businesses in the blog.

Traditional pricing is dead. Dynamic pricing is the future.

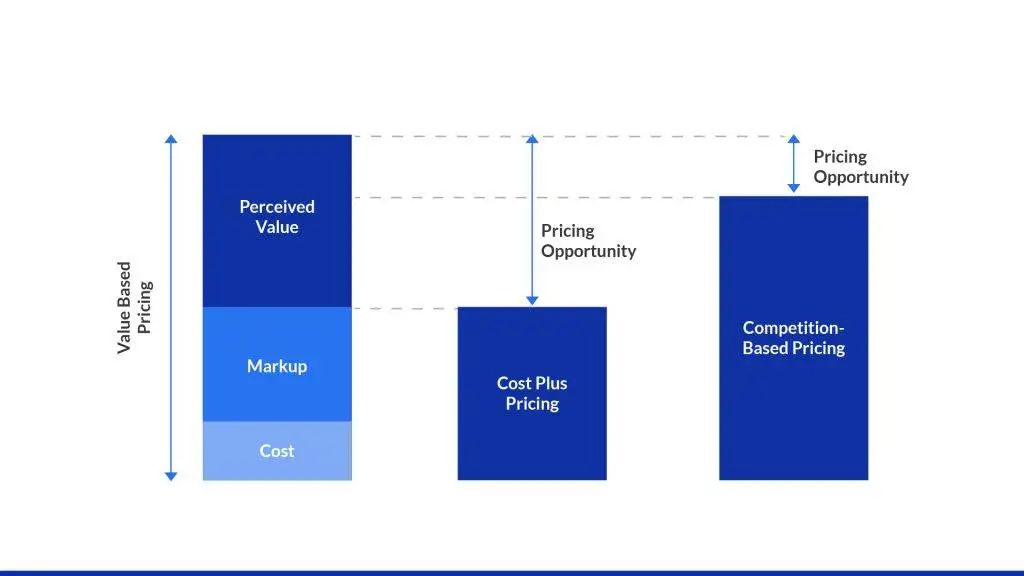

For decades, traditional pricing methods have been the go-to approach for setting product prices. Traditional pricing relies on a fixed pricing structure that remains unchanged for extended periods. This static pricing approach has its merits, offering simplicity and ease of implementation. The most common methods include cost-plus pricing, competitor-based pricing, and value-based pricing. These methods provide a baseline for setting prices, but they are far from perfect.

Limitations of traditional pricing

Inflexibility: Traditional pricing models are rigid and fail to adapt to market fluctuations. They do not account for changes in demand, seasonal variations, or shifts in consumer preferences. This often leads to missed revenue opportunities during peak periods or surplus inventory during off-seasons.

Competitive Disadvantage: Relying solely on competitor-based pricing can result in a race to the bottom, eroding profit margins. Companies using traditional pricing methods are often caught in a pricing war, making it difficult to differentiate themselves and maintain profitability.

Underpricing or Overpricing: Traditional pricing methods may not accurately reflect the perceived value of a product. This can lead to underpricing, leaving potential profit on the table, or overpricing, deterring price-sensitive customers.

The birth of dynamic pricing

The limitations of traditional pricing have fueled the rise of dynamic pricing, an innovative approach that leverages data and algorithms to continuously adjust prices based on real-time market conditions, demand, and other factors. Dynamic pricing represents a paradigm shift in pricing strategy, addressing the shortcomings of traditional methods head-on. It evolved from a need to do more than just fix prices statically.

Although the idea of dynamic pricing was not novel and had already been implemented by airlines in the 1980s, the initial version of dynamic pricing software was introduced in the early 1990s. At that time, the solutions were cumbersome and difficult to integrate, but with the advancement of technology, a new generation of user-friendly dynamic pricing solution emerged.

Must Read: 9 Real-world Dynamic Pricing Examples You Should Know

Today’s dynamic pricing software harnesses the immense power of advanced data analytics. They can analyze vast volumes of data, including historical sales data, competitor pricing, website traffic patterns, and customer demographics. These sophisticated algorithms delve deep into market trends and customer behavior, enabling businesses to make informed pricing decisions.

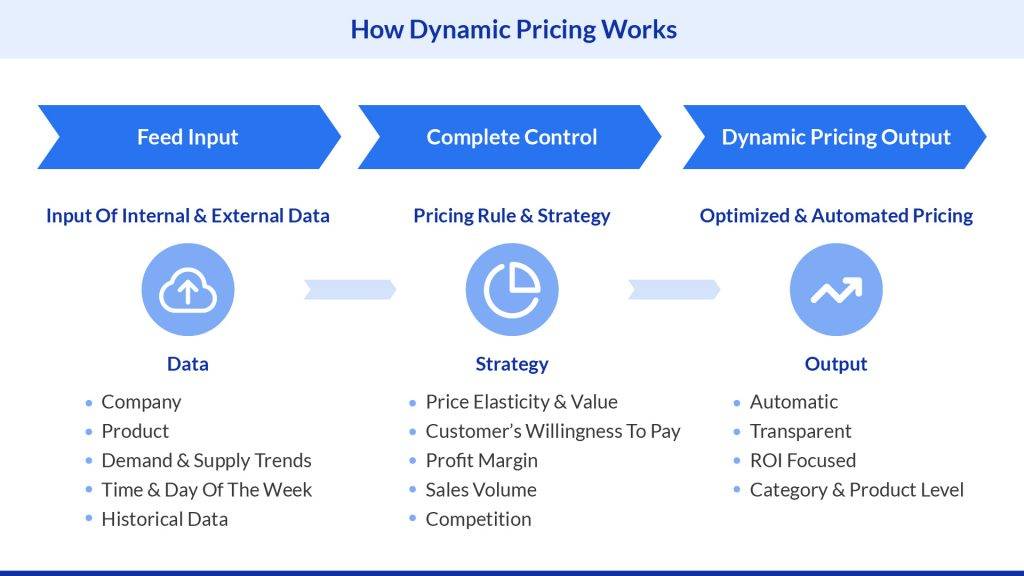

Here’s how it works:

Data-Driven Insights

Dynamic pricing relies on a wealth of data sources, including historical sales data, competitor pricing, website traffic, and customer demographics. By analyzing this data, businesses gain a deep understanding of market trends and customer behavior, allowing them to make informed pricing decisions.

Real-Time Adjustments

Unlike traditional pricing, which adjusts prices at predetermined intervals, dynamic pricing adapts continuously. Prices can change in real-time to reflect changes in demand, inventory levels, or competitor pricing. This agility enables businesses to maximize revenue and minimize waste.

Personalization

Dynamic pricing takes into account individual customer preferences, allowing businesses to offer tailored pricing to different customer segments. This personalization not only enhances customer satisfaction but also increases the likelihood of upselling and cross-selling.

How dynamic pricing algorithms operate

Dynamic pricing algorithms operate at the intersection of AI and ML technologies, revolutionizing traditional pricing strategies. These algorithms enable scalability in pricing decisions, shifting retailers from SKU-centric to portfolio-based pricing, considering various dependencies, both explicit and implicit.

One remarkable feature of dynamic pricing algorithms is their flexibility. Retailers can tailor prices to target specific shopper groups by crafting optimal value offerings based on market trends, demand fluctuations, customer behavior, purchasing power, and numerous other factors.

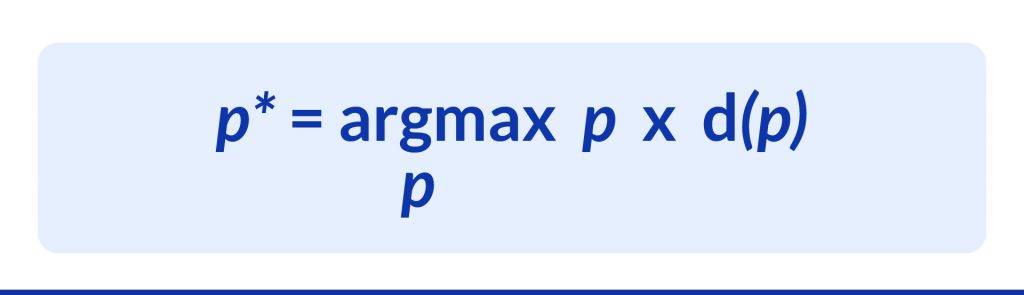

A fundamental aspect of these algorithms is understanding the relationship between price and demand. This crucial estimation allows the calculation of revenue-optimal prices using the below formula:

Here the price (p) and the demand function (d(p)), serves as the foundation, with dynamic software engines expanding it to consider a plethora of pricing and non-pricing factors. These factors encompass procurement expenses, inventory costs, demand cannibalization, competitor pricing, promotional activities, and more. The algorithm’s accuracy improves as it processes diverse and relevant data points.

Historical sales data forms the basis for estimating the demand function in most pricing algorithms. The workflow typically consists of four main stages:

- Historical data on price points and demand is processed by the dynamic pricing algorithm.

- The demand function is constructed based on identified dependencies.

- Advanced mathematical processes incorporate pricing and non-pricing factors to generate optimal prices.

- After applying recommended prices, the algorithm iterates, considering the latest repricing results.

While this represents a fundamental workflow pattern, dynamic pricing algorithm models are customized to fit the specific objectives and constraints of each retailer.

Also Read: How Dynamic Pricing Solution Leverage Machine Learning

Even Though basic dynamic pricing algorithms offer significant advantages, they have limitations. They often rely heavily on historical sales data, which may not capture rapidly evolving market trends. Additionally, they may struggle to strike a balance between exploring new pricing strategies and exploiting known successful ones. This is where the explore-vs-exploit algorithm comes into play.

Explore-vs-exploit algorithm: A key enhancement

Explore-vs-exploit algorithms are a crucial addition to dynamic pricing software, addressing the limitations of basic dynamic pricing models. These algorithms play a pivotal role in helping retailers make informed pricing decisions in dynamic and competitive markets. Let’s delve deeper into their role, providing an analytical example to illustrate their significance.

The Explore-vs-Exploit Dilemma

In dynamic pricing, the explore-vs-exploit dilemma arises from the need to strike a balance between two fundamental strategies:

Exploration: This involves trying out new pricing strategies, even if they are not proven, to gather information and learn about their effectiveness. Exploration is akin to “testing the waters” to discover potentially better pricing opportunities.

Exploitation: On the other hand, exploitation entails using pricing strategies that have been proven effective based on historical data. This strategy involves maximizing immediate returns by leveraging known, successful pricing approaches.

Imagine a retailer selling a popular consumer electronic product, such as a high-end smartphone, in a competitive market. The retailer uses a basic dynamic pricing algorithm that relies heavily on historical data, competitor prices, and demand patterns to set prices for particular products. However, this algorithm has limitations, as it may not adapt quickly to changes in customer preferences or market dynamics.

Exploration Phase

During the exploration phase, the explore-vs-exploit algorithm might introduce slight price variations, perhaps slightly lowering the smartphone’s price for a limited time or bundling it with complementary accessories. This exploration aims to attract new customers, especially price-sensitive ones, and gauge their response to these changes.

For instance, the retailer could temporarily reduce the smartphone’s price by 5% for a one-week period and monitor the impact on sales and profit margins. During this time, the algorithm collects real-time data on customer reactions, including changes in demand and competitor responses.

Exploitation Phase

In the exploitation phase, the algorithm leverages the insights gained during the exploration phase to make informed pricing decisions. If the data from the price reduction experiment showed a significant increase in sales and profit margins without sacrificing too much revenue, the algorithm might exploit this knowledge.

For example, the algorithm could adopt a dynamic pricing strategy that lowers the smartphone’s price by 5% during peak shopping hours, targeting price-sensitive customers, while maintaining a higher price during less competitive periods. This exploitation strategy maximizes immediate returns based on the knowledge gained through exploration.

Benefits of Explore-vs-Exploit Algorithms

Explore-vs-exploit algorithms offer several key benefits in the context of dynamic pricing:

- Adaptation to Change: These algorithms enable retailers to adapt quickly to changing market conditions, customer behaviors, and competitive pressures. They are not rigid and can respond to emerging trends and opportunities.

- Optimized Decision-Making: By balancing exploration and exploitation, these algorithms ensure that retailers make pricing decisions that maximize both short-term and long-term goals, achieving a fine-tuned equilibrium.

- Enhanced Competitiveness: Retailers using explore-vs-exploit algorithms can stay competitive by consistently testing and adopting innovative pricing strategies that differentiate them from competitors.

- Data-Driven Insights: Through exploration, these algorithms generate valuable data and insights about customer preferences and market dynamics, which can inform future pricing decisions and overall business strategies.

- Improved Customer Experience: Retailers can cater to a broader range of customer segments, including price-sensitive shoppers, by tailoring pricing strategies based on real-time data.

Flipkart Commerce Cloud, at the forefront of dynamic pricing software development, has embraced modern algorithms, including the explore-vs-exploit approach. By integrating these advanced algorithms into our dynamic pricing engine, we have empowered retailers with more effective pricing strategies.

How to choose the dynamic pricing model?

Today, choosing the right dynamic pricing model is crucial for staying competitive and maximizing profitability. But with the myriad of options available, how do you make the right choice? Here’s what you must consider.

Understand your business goals

Before diving into dynamic pricing models, it’s essential to clarify your business objectives. Are you aiming to maximize short-term revenue, capture market share, optimize profit margins, or enhance customer loyalty? The choice of a pricing model should align closely with your overarching goals.

For instance, if you’re in a highly competitive market and want to capture market share, an aggressive dynamic pricing strategy might involve undercutting competitors’ prices during peak shopping seasons. Conversely, if profit optimization is your primary objective, a more conservative approach with price stability may be preferable.

Analyze your market dynamics

Market dynamics play a pivotal role in shaping your pricing strategy. Factors such as customer demand, competitor pricing, seasonality, and economic conditions can significantly impact your pricing decisions. Analyze your market thoroughly to understand its volatility and the extent to which prices need to adapt.

In e-commerce, for instance with an online fashion retailer, market dynamics like customer demand, competitor pricing, seasonality, and economic conditions shape pricing strategy. Analyzing these factors and swiftly adapting prices to market changes is key to staying competitive and optimizing sales.

Consider your product portfolio

Different products within your portfolio may have varying price sensitivities and demand patterns. Therefore, it’s vital to choose a dynamic pricing model that can account for these differences effectively. Some models excel at portfolio-based pricing, while others are better suited for individual product optimization.

For instance, if you offer a range of products, including both premium and budget options, a model that can differentiate pricing strategies based on product attributes and customer segments is valuable. This ensures that you can cater to various customer preferences and maximize profitability across your product mix.

Evaluate data availability and quality

Dynamic pricing heavily depends on data, encompassing historical sales data, competitor pricing information, and market trends. It’s essential to evaluate the accessibility and reliability of your data sources. If your data is scarce or untrustworthy, it could hinder the efficacy of specific dynamic pricing models.

Partnering with a SaaS pricing solution trained on a wealth of diverse data can offer a superior alternative. This strategy not only obviates the necessity for substantial investments in data quality and integration capabilities but also alleviates concerns about your organization’s ability to oversee data analysis and model upkeep.

Explore algorithmic complexity

Dynamic pricing models range from simple rules-based systems to sophisticated machine learning algorithms. The complexity of the algorithm should align with your organizational capabilities and goals.

For example, if you have a dedicated data science team and access to substantial computing resources, you can explore advanced machine learning models that adapt to complex market dynamics. On the other hand, if your resources are limited, a more straightforward rule-based model may be a pragmatic choice to start with.

Adaptability and scalability

Finally, consider the adaptability and scalability of the chosen dynamic pricing model. Markets evolve, and your business will grow. Ensure that the selected model can adapt to changing circumstances and accommodate an expanding product portfolio or customer base.

What are the challenges in creating a successful dynamic pricing algorithm?

Creating a successful dynamic pricing algorithm poses several challenges. These include accurately predicting customer behavior, determining optimal price points, accounting for market dynamics and competition, handling large volumes of data, and ensuring fairness and transparency in pricing decisions.

Must Read: Why you should not use Excel to build your dynamic pricing strategy

FCC’s dynamic pricing algorithm in action: The impact

At Flipkart Commerce Cloud, we orchestrated a retail revolution by seamlessly blending Competitive Intelligence with our Dynamic Price Manager. This fusion empowered an omnichannel retailer to rise above the competition, leveraging real-time insights into rival pricing to enhance price perception and boost customer conversion rates.

Our dynamic pricing solution, powered by a cutting-edge rules engine and historical data analysis, optimized SKU pricing in alignment with margin, revenue, and competitiveness goals. Additionally, our 360° market view granted a strategic advantage by unraveling the competitive landscape. The result? A dynamic pricing algorithm in action, catalyzing a retail transformation that redefines success in today’s ever-evolving marketplace.

Access the complete case study here.

Dynamic Pricing: your key to revenue maximization and market dominance

Dynamic pricing is not just a tool; it’s your key to unlocking the full potential of revenue maximization and achieving market dominance. In a rapidly evolving business landscape, where market trends shift in the blink of an eye, the ability to adapt and optimize pricing strategies is paramount. By harnessing the power of dynamic pricing, businesses can seamlessly align their prices with customer demand, competitive forces, and changing economic conditions. This not only drives revenue growth but also positions them as market leaders, ready to navigate the dynamic currents of the business world.

The journey to market dominance begins with a simple yet transformative step – embracing dynamic pricing as a cornerstone of your strategy. Wondering how? Talk to our experts today!