16 Retail Pricing Strategies For Increased Sales in 2025

By Flipkart Commerce Cloud

Share On:

Setting up an ideal retail pricing strategy is crucial for any business to ensure profitability. The perfect retail pricing strategy lies in finding the delicate balance between profitability and customer appeal. Price products too low, and you risk leaving potential profits on the table; price them too high, and you might scare off potential buyers.

In this blog post, we will explore 16 retail pricing strategies for 2025 that will help you unleash the power of profitability and drive increased sales.

What is Retail Pricing?

Retail pricing is the price that consumers pay for a finished product when it is sold. This price is determined by a number of factors, including the cost of goods sold, the desired profit margin, and the competitive landscape of the target market.

In general the retail price you set for any of your products includes the cost of the product plus the added markup you want to gain as profit from selling the product. In other words, retail pricing can be calculated with the following formula:

Retail Price = Cost of Goods + Markup

For instance, if the Cost of Goods for a product is €100, and the markup percentage is 50%, the resulting retail price would be €150.

Undeniably, retail pricing plays a pivotal role in determining a business’s profitability. If the retail price is set too high, potential customers may be discouraged from making a purchase. Conversely, if the retail price is too low, the business may struggle to make a profit.

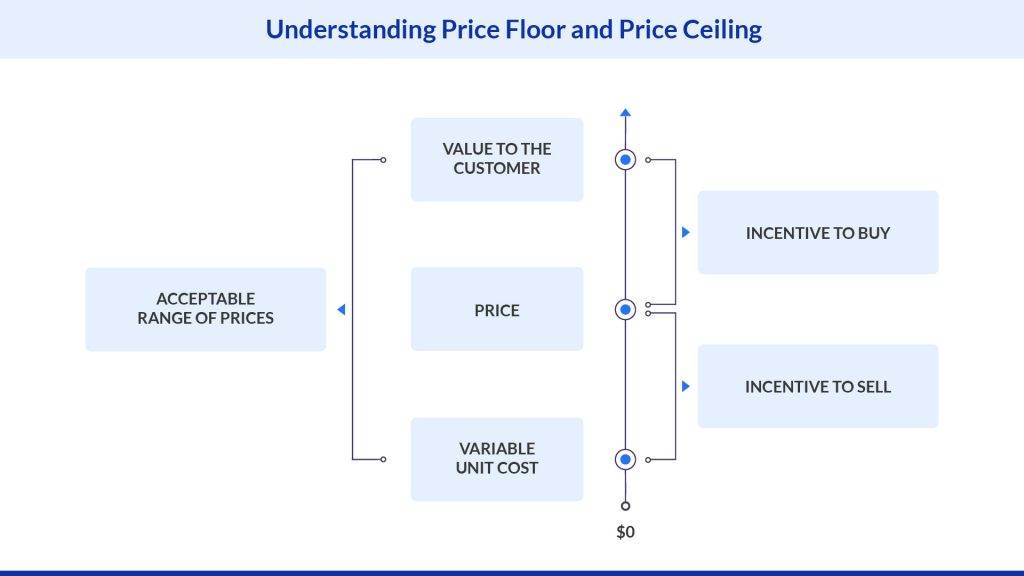

While setting a retail pricing strategy for your business, the ultimate goal is to find the ideal retail price that maximizes profit while remaining attractive to customers. The retail price should fall somewhere between the perceived-value and variable unit cost as shown below in the graph:

According to Eric Dolansky, Associate Professor of Marketing at Brock University in St. Catharines, Ont., “How much the customer is willing to pay for the product has very little to do with the seller’s cost and has very much to do with how much they value the product or service they’re buying.”

Apart from the customer preferences there are multiple other factors that influence retail pricing decisions. Let’s take a closer look at these factors.

Factors that Affect Retail Pricing

Setting the right retail price is a crucial aspect of any successful business. However, arriving at the perfect price point is not a one-size-fits-all approach. Several internal and external factors come into play, influencing pricing decisions and ultimately shaping the success of your products or services in the market.

Internal Factors

Cost of Goods Sold (COGS):

The foundation of any pricing strategy lies in understanding the Cost of Goods Sold (COGS). This includes the expenses associated with producing or acquiring the product, encompassing raw materials, manufacturing costs, labor, and overhead. Accurate accounting of COGS is essential to ensure that your prices cover these expenses while providing room for profit.

Profit Margins:

Your desired profit margin plays a pivotal role in determining your retail price. Whether you aim for higher profit margins to boost revenue or lower margins to stay competitive, it is essential to strike the right balance that aligns with your business goals and market positioning.

Business Objectives:

Consider your overall business objectives when setting product prices. Are you aiming to capture market share, establish a premium brand, or increase customer loyalty? Different objectives may call for different pricing strategies to achieve desired outcomes.

Product Lifecycle:

The stage of a product’s lifecycle can also impact pricing decisions. For new or innovative products, you might initially set a higher price to recoup development costs, while established products may benefit from competitive pricing to maintain market share.

External Factors

Market Demand:

Understanding customer preferences and market demand is paramount in determining the right price point. If demand is high and supply is limited, higher prices might be justified, whereas lower demand may call for competitive pricing to attract customers.

Competitive Landscape:

Monitor your competitors’ pricing strategies closely. If you offer similar products or services, pricing at a significantly higher or lower level could affect your market position and customer perception.

Economic Conditions:

Economic fluctuations, inflation rates, and changes in consumer purchasing power can influence consumer behavior and their willingness to pay certain price points.

Target Market:

Different customer segments may have varying price sensitivities. Understanding your target audience’s preferences and purchasing power will help tailor pricing strategies to appeal to specific customer groups.

Now that we understand the factors affecting pricing, let’s explore strategies for maximizing sales.

7 most common pricing strategies used in ecommerce

Cost-plus pricing strategy

Cost-plus pricing is a pricing strategy that sets prices based on the cost of goods sold plus a markup percentage. The markup percentage is typically a fixed amount, but it can vary depending on the product, the industry, and the retailer’s desired profit margin.

The basic formula of cost-plus pricing is:

Final Retail Price = Cost of product + Markup

For example, if the cost of goods for a product is €100 and the markup percentage is 50%, then the retail price would be €150.

Pros of cost-plus pricing:

- Preferred method of pricing for retailers launching their product for the first time and have limited visibility on the market

- Useful when you are launching a new product for which historical data is unavailable

- Simple to calculate and easy to convey to your customers

Cons of cost-plus pricing:

- Does not take into account customer preferences, competition or price elasticity of demand

- Can lead to loss in profits due to overpricing or underpricing

- Not as flexible as other pricing strategies

Competitive pricing strategy

Competitive pricing strategy is the pricing approach where you set your product pricing based on what your competitors are charging. This strategy is often used in industries where there are many similar products, such as the electronics industry.

For example, a retailer sells a smartphone for $500. The average price of a similar smartphone in the market is $600. The retailer is using a competitive pricing strategy by setting their price below the average market price.

Sometimes, retailers also change their pricing higher than the average market price to differentiate themselves as a premium product. In a nutshell, Competitive pricing strategy follows the below formula:

Retail pricing = Cost of product + Market factor price + Premium pricing

Where market factor price is determined by the competition and other market data reference and the premium pricing is based on the exclusive product features. The point to note here is that not all competition-based pricing strategies will consider the premium pricing.

Here are the three main types of competitive pricing:

- Cooperative pricing: In this type of pricing approach, the retailers match the pricing to what their competitors are offering. For example, if the competition is increasing the product price by $10, you will also increase your product price to match. This is often done to maintain the status quo.

- Aggressive pricing: This type of pricing involves setting your product prices lower than the competition in order to gain market share.

- Dismissive pricing: This type of pricing involves setting prices higher than the competition in order to position the product as a premium product.

Competition based pricing can help retailers gain market share and establish themselves as leaders when implemented correctly with the help of advanced pricing software like Flipkart Commerce Cloud.

Flipkart Commerce Cloud provides a comprehensive competitive intelligence tool for businesses. Using automated mapping and crawling features, users can effortlessly track price fluctuations of millions of rival products. Its advanced AI/ML algorithm identifies identical and similar items, giving a holistic view of the competitive market. With its user-friendly interface, businesses can make informed pricing decisions and stay ahead of the competition.

Outperform your competitor’s with the smartest competitive intelligence tool in the market. Book your strategy call with FCC’s experts today!

Penetration pricing strategy

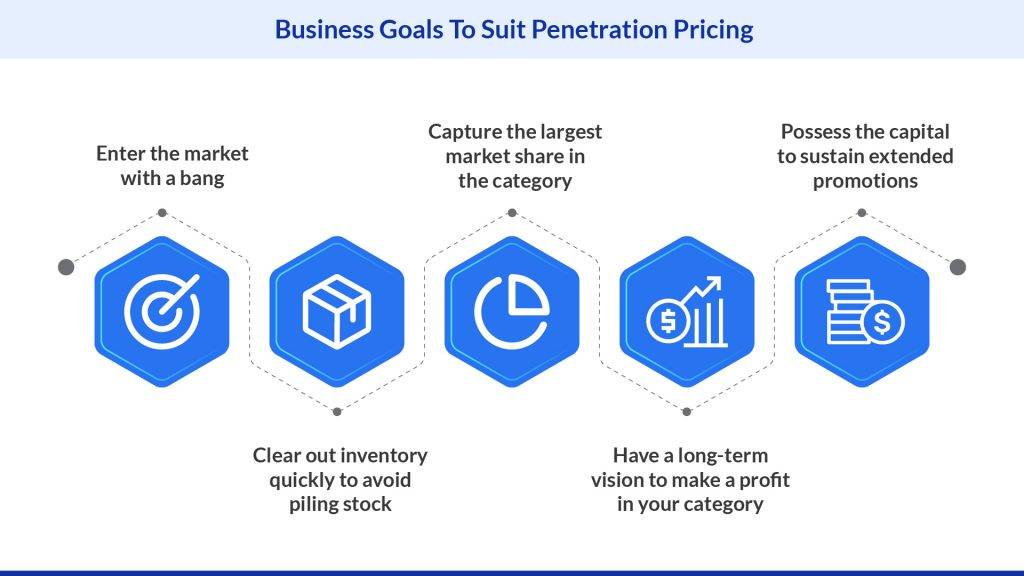

Similar to competitive pricing, there’s another clever strategy called penetration pricing— a strategy where retailers set the prices low in order to attract new customers. This strategy is often used when a new product is launched or when a business is entering a new market.

Penetration pricing can be a risky strategy, as it can lead to losses if the business does not generate enough sales. However, if the strategy is successful, it can help the business to gain market share and establish a strong brand.

Online streaming services and internet service providers often use penetration pricing to attract customers and gain market share. Ikea, a contemporary-style furniture brand, also uses penetration pricing to establish a strong presence in new geographies. For example, while launching in India, they priced their products 30-40% lower than their organized competitors. Once the brand establishes, they then use other pricing strategies like competitive pricing to have a competitive edge over other brands; and promotional pricing as a tactic to drive sales, clear inventory, and make room for new products.

Price skimming strategy

Price skimming, another smart retail pricing strategy, operates by gradually reducing prices over time to stimulate sales growth. In this approach, retailers initiate a product launch with higher prices and subsequently lower them. High-end electronics companies often use this strategy to attract their early customers— the tech enthusiasts.

Apple is a brand that has mastered the art of price skimming. Their consistent practice of introducing new products at premium price points is rooted in an astute understanding of consumer behavior. By targeting the early adopters who are willing to invest in cutting-edge technology, Apple leverages demand elasticity for initial substantial profit margins.

Following the saturation of this high-end consumer segment, Apple shifts gears by systematically reducing prices, to engage a broader audience. This strategic approach aligns with Apple’s overarching objective of maintaining brand resonance and extending market reach.

That being said, price skimming does come with its own risks.

Value Demonstration at Launch: A risk in price skimming lies in the pre-launch phase. Convincing early adopters of a product’s value at its premium price is crucial. Failure to communicate the worth of the “hot new thing” can lead to lackluster initial sales.

Copycat Competitors Eroding Market Share: When a product is priced too high, it can draw the attention of competitors who want to copy its success. This is a real danger because copycat manufacturers or rivals can quickly enter the market with cheaper options, making the high-priced product less attractive to its customers.

Diminished Tail-end Potential: As the strategy advances, there’s a notable risk that a skimming-focused business might encounter diminishing returns. Having successfully capitalized on early adopters’ enthusiasm, the later stages could see saturation, resulting in reduced demand and a decline in sales potential.

Premium pricing strategy

As the name suggests, premium pricing is a pricing strategy where brands set prices high in order to position a product as a premium, high-value product. This tactic is often favored by luxury brands that have devoted substantial resources to carefully shape their brand identity, radiating that exceptional, top-of-the-line feel.

While premium pricing can be a lucrative strategy, it can constrict the potential market for a product. The exceptionally high price-point naturally narrows the pool of potential buyers, as the product will be attractive to only those who place a premium on exclusivity and luxury. This pricing approach is also susceptible to market volatility when competitors introduce comparable products at lower price points, leading to a potential loss of market share.

Louis Vuitton is a luxury fashion brand that uses premium pricing. Their products are priced high, but they are also perceived to be high quality and unique. This allows Louis Vuitton to maintain a strong brand image and generate high profits.

Pros of premium pricing:

- Sets the stage for a business to establish itself as a top-notch, premium brand.

- Draws in customers who don’t mind splurging on top-quality goods.

Cons of premium pricing:

- Can put a cap on the product’s market, as only a select few can afford the high price tag. In such cases, retailers often introduce a more affordable line to tap into a wider audience.

- Can be difficult to maintain if the competition lowers their prices and take away the market share.

Value-based pricing strategy

Value-based pricing is a strategic approach centered on the customer’s perceived value of a product, reflecting how well it aligns with individual needs and desires. This method stands in contrast to other pricing strategies as it emphasizes catering to customer perspectives rather than a cost-driven or competition-based model.

When the product pricing is aligned with what the customers are willing to pay, the chances of sales are higher – making it one of the most sought-after retail pricing strategies. Even though the approach is unsuitable for retailers offering commodities, value-based pricing holds immense value for businesses offering distinctive products.

How to set value-based pricing?

Retailers can effectively implement value-based pricing by following these five strategic pointers:

- Customer Insights: Gain deep insights into customer preferences, needs, and pain points. Understand what aspects of your product or service hold the most value for your target audience.

- Benefit Identification: Identify and highlight the unique benefits and features of your offering that resonate with customers. Determine how your product solves their problems or enhances their experience.

- Quantify Value: Quantify the value your product brings to customers. Calculate the tangible benefits they receive, such as cost savings, time efficiency, convenience, or improved outcomes.

- Comparative Analysis: Research comparable products in the market to understand their pricing and value propositions. Evaluate how your offering differentiates itself and justifies a premium based on its distinctive value.

- Effective Communication: Develop clear and persuasive messaging that communicates the quantified value of your product to customers. Explain how your offering addresses their specific needs and adds value beyond what competitors provide.

Keystone pricing strategy

The keystone pricing strategy is a straightforward and commonly employed approach in retail pricing. It involves setting prices for products at double the wholesale cost, effectively establishing a 100% markup. This strategy is favored for its simplicity and ease of calculation, making it particularly useful for small businesses or those dealing with a wide range of products. While keystone pricing ensures consistent profitability, it may not always align with the perceived value of the product in the eyes of customers.

Retailers should consider market trends, competition, and customer expectations to ensure that the chosen markup accurately reflects both their costs and the value perceived by their target audience.

Pros of keystone pricing:

- Simple to understand and easy to implement

- Is a good pricing strategy for products that are perceived to be of high value

Cons of keystone pricing:

- Might yield lower profits compared to alternative pricing strategies

- Does not take into account the customer’s perception of value

- Can be difficult to maintain if the cost of goods sold increases or competition lower their prices

If you’re looking for more out of the box pricing strategies, keep reading.

Other Pricing Strategies That You Can Use

Discount Pricing Strategy

Discount pricing is a powerful strategy that entices customers by offering prices below the regular price. It’s commonly used to clear out inventory, promote new products, or compete with rivals. While it can boost sales, it requires caution. Extremely low prices can harm the brand image and lead to reduced profits. Monitoring competitors’ prices is crucial to avoid undercutting your own.

Costco is a well-known example of a company that uses discount pricing. Employing a markup of 14-15% above costs, the brand maintains a narrow profit margin of 2%, positioning itself as a key player in the wholesale market. The bulk sales approach enables Costco to offer lower prices, a facet intrinsically linked to the brand’s identity of large-scale items and expansive warehouses.

Crafting a discount pricing strategy requires careful consideration to ensure its effectiveness and alignment with business goals. Here’s what you should consider:

- Selective Scarcity: Employ scarcity psychology by offering discounts on select, limited-quantity items. This approach generates a sense of urgency, motivating customers to make quicker purchasing decisions to secure the deal.

- Perceived Value Reinforcement: While discounts attract attention, they shouldn’t erode the perceived value of your products or services. Strategically position discounts on select items to accentuate their desirability without undermining the overall brand image.

- Gamified Discounts: Infuse gamification by offering customers the opportunity to earn or unlock discounts through specific actions, such as social sharing, referrals, or participating in challenges. This interactive approach enhances customer engagement and expands brand reach.

- Loyalty-Based Discounts: Tailor discounts to loyal customers, rewarding them for their ongoing patronage. Elevate this approach by offering tiered discounts that increase in value as customers progress in their loyalty journey.

Everyday Low Pricing (EDLP) Strategy

EDLP involves maintaining consistent prices instead of fluctuating with the market. This strategic approach resonates with retailers aiming to establish a distinguished reputation as value providers. Beyond its surface simplicity, EDLP helps in nurturing customer loyalty while simultaneously drawing new buyers into the fold. When implementing Everyday Low Pricing for your business, It’s vital to strike a balance in pricing to cover costs and make a profit while still maintaining the effectiveness of the strategy in the long run.

Some prominent examples of retailers following EDLP pricing strategies include Lidl, Trader Joe’s and Walmart. Trader Joe’s sells a bag (1Lb) of organic carrots for about $1, which is the same price that they have been selling it for for years. This consistent pricing helps Trader Joe’s to build customer loyalty and to attract new customers who know that they can always find a good deal at Trader Joe’s.

High-low pricing strategy

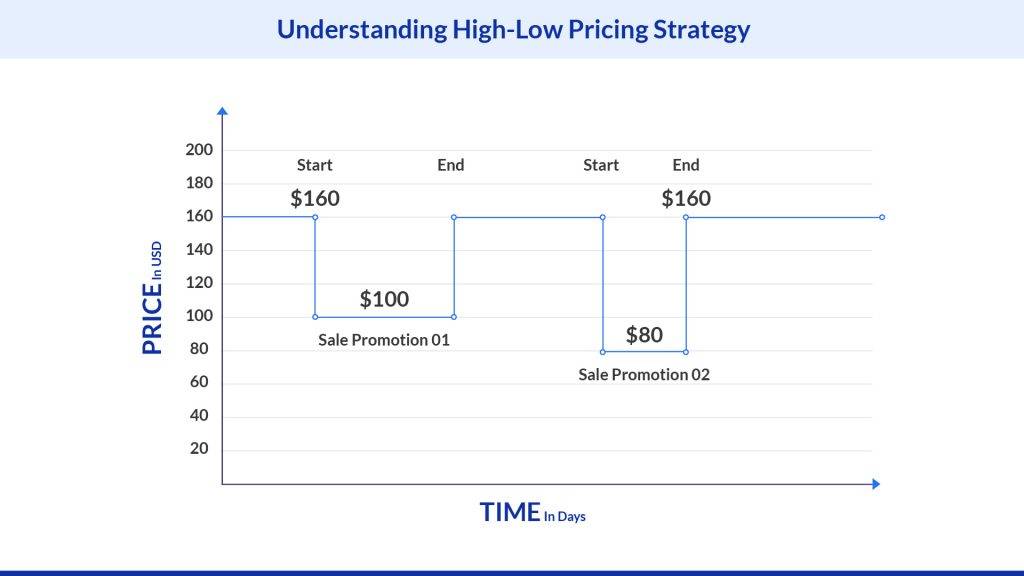

High-low pricing is a strategic pricing approach wherein retailers initiate products with higher prices and subsequently reduce them over time. This tactic is particularly popular in seasonal products like apparel and footwear, which experience fluctuating demand throughout the year.

Macy’s, a US department store, uses high-low pricing to clear inventory quickly and make room for new products. The store often offers discounts on seasonal products, such as apparel and footwear. For example, Macy’s might offer a 25% discount on winter coats in March, when demand for winter coats is starting to decline. This allows Macy’s to clear inventory quickly and make room for spring merchandise.

Macy’s also uses high-low pricing to attract consumers who are looking for a bargain. The store often offers coupons and promotions that can save shoppers a significant amount of money. For example, Macy’s might offer a $10 coupon off of a purchase of $50 or more.

Dynamic Pricing Strategy

Often used by online retailers, dynamic pricing is the one in which prices are constantly adjusted based on factors such as supply and demand, competition, and customer behavior.

There are two main types of dynamic pricing:

Reactive dynamic pricing: This type of pricing involves adjusting prices in response to changes in supply and demand. For example, if a product is in high demand, the price may be increased to take advantage of the demand. Conversely, if a product is not in high demand, the price may be decreased to try to attract more buyers.

Proactive dynamic pricing: This type of pricing involves adjusting prices in anticipation of changes in supply and demand. For example, a retailer may use historical data to predict when demand for a product is likely to increase, and then increase the price of the product in advance.

Dynamic pricing can be a very effective way to maximize revenue. By adjusting prices in real time, retailers can ensure that they are always charging the right price for their products. This can help them to attract more customers, increase sales, and boost profits.

Here’s how dynamic pricing is ideally calculated:

- Data Collection: Businesses gather vast data from sources like sales history, competitor prices, demand patterns, market trends, and external factors like weather or holidays.

- Analysis: Advanced AI/ML algorithms analyze data for patterns and correlations, recognizing shifts in demand and predicting price impacts.

- Real-time Adjustment: The pricing engine recalculates prices in real-time based on analysis. Adjustments can be continuous or periodic as per business strategy and market volatility.

Sophisticated solutions like FCC’s Dynamic Pricing Engine offer businesses a suite of capabilities for optimal dynamic pricing strategy:

- Advanced AI/ML Algorithms: FCC employs cutting-edge AI/ML algorithms to scrutinize market data and predict demand, empowering businesses with well-informed pricing decisions.

- Real-time Price Updates: FCC facilitates real-time price adjustments in response to evolving market conditions, ensuring accurate product pricing at all times.

- Customizable Pricing Rules: Businesses can shape their pricing strategy with FCC’s customizable pricing rules, enhancing control over pricing dynamics.

- Insightful Reporting and Analytics: FCC equips businesses with insightful reports and analytics, enabling them to assess pricing performance and make strategic refinements.

Psychological Pricing Strategy

One of the most intriguing retail pricing strategies is psychological pricing. This strategy uses human psychology to influence consumers’ perceptions of price and value. By understanding how consumers think about price, retailers can use psychological pricing to increase sales and profits.

There are many different psychological pricing techniques that retailers use. Some common techniques include:

- Price anchoring: This technique involves setting a high anchor price, then offering a lower price that seems like a good deal. For example, a retailer might sell a shirt for $50, then offer a sale price of $25. The $25 price seems like a good deal, even though it is still above the true cost of the shirt. (More on this below)

- Odd pricing: This technique involves pricing products at odd prices, such as $9.99 or $19.95. This type of pricing is thought to make products seem more affordable than if they were priced at even prices, such as $10 or $20.

- Value pricing: This technique involves pricing products at a perceived value, rather than at the actual cost. For example, a retailer might sell a watch for $200, even though it only cost $100 to make. The retailer is hoping that consumers will perceive the watch as being worth $200, even though it is not.

- Decoy Pricing: Introducing a third, less attractive option can make a primary product seem more appealing in comparison. For instance, placing a high-priced option next to a mid-priced one can make the mid-priced product appear more reasonable.

Subscription Pricing: By breaking down the cost into smaller, recurring payments, subscription models can mask the overall expense and reduce the perceived financial burden.

Bundled pricing strategy

Bundled pricing, which can also be considered a type of psychological pricing, is the one that involves selling two or more products together for a single price. This strategy is often used to sell products that are complementary or that are often used together.

There are two main types of bundled pricing:

Pure bundling: In pure bundling, the products in the bundle cannot be purchased separately. For example, a retailer might sell a printer and ink cartridges as a bundled product. The customer must purchase both the printer and the ink cartridges in order to use the printer.

Mixed bundling: In mixed bundling, the products in the bundle can be purchased separately, but they are offered at a discounted price when purchased together. For example, a retailer might sell a printer and a scanner as a bundled product. The customer can purchase the printer and the scanner separately, but they will receive a discount if they purchase them together.

Pros of bundled pricing:

- Bundles encourage customers to buy more than they initially intended, boosting overall sales.

- By combining products, businesses can leverage higher perceived value and maximize profits.

- Bundles meet diverse needs, enhancing customer experience and building loyalty.

Cons of bundled pricing:

- Managing multiple components and pricing tiers in bundles can be operationally challenging.

- Some customers may feel pressured or manipulated into purchasing items they don’t need.

- In certain cases, bundled pricing may raise legal concerns or antitrust issues, necessitating caution.

Manufacturer suggested retail price (MRP)

The Maximum Retail Price (MRP) pricing strategy is a widely used approach that involves setting the highest price at which a product can be sold to consumers, encompassing production costs, distribution expenses, and desired profit margins. This strategy serves as a reference point for both consumers and retailers, offering transparency and consistency in pricing.

Take the case of a soft drink company implementing the Maximum Retail Price (MRP) strategy. By setting a standardized price for its products across different retail channels, the company not only maintains equity for customers but also safeguards against any potential instances of price gouging. This practice contributes to cultivating a foundation of consumer confidence and reliability in the brand’s pricing integrity.

Pros of MRP Pricing:

- MRP pricing provides clear and consistent pricing information, enhancing consumer trust and reducing confusion.

- Setting an MRP prevents retailers from overcharging customers during times of high demand or scarcity, protecting consumers’ interests.

- MRP ensures uniform pricing across various retailers, preventing price disparities and fostering fair competition.

Cons of MRP Pricing:

- MRP pricing may limit retailers’ ability to offer dynamic pricing strategies, hindering their response to market changes and consumer behavior.

- Businesses may find it challenging to tailor pricing to specific customer segments or geographic locations under MRP.

- Consumers may perceive MRP pricing as less flexible, potentially influencing their purchasing decisions based on price alone.

Price anchoring strategy

Price anchoring is a clever pricing strategy where businesses set a reference price for customers to consider when making a purchase. When a discount is offered, the higher original price acts as an anchor, influencing how customers perceive the sale price.

This tactic plays on the idea that customers compare the discounted price to the higher anchor price, making the sale price appear more attractive and encouraging purchases.

Imagine a consumer shopping for a new television. The retailer strategically places a high-end television with a price tag of $2,000 next to a slightly smaller, similar-quality TV priced at $1,500. By anchoring the customer’s perception to the higher-priced television, the $1,500 option seems like a better deal in comparison, despite its own relatively high cost.

This psychological effect prompts customers to perceive the $1,500 TV as offering a significant discount, even though it might still be higher priced compared to other options on the market. The price anchor of the $2,000 TV guides customers’ perceptions and influences their purchasing decisions, ultimately driving sales and revenue for the retailer.

Loss leader pricing strategy

One of the trickiest retail pricing strategies, loss leader pricing is a strategy where a company sets the price of a product below its cost with the intention of attracting customers to the store or website. The company expects that while customers are buying the heavily discounted item, they will also purchase other products with higher profit margins, compensating for the initial loss on the loss leader product.

For example, Costco, a membership-only warehouse club, uses loss leader pricing on a variety of products, including rotisserie chickens, gasoline, and alcohol. The rotisserie chicken is a classic example of a loss leader product at Costco. Costco sells rotisserie chickens for $4.99, which is well below the cost of production. However, Costco makes up for the loss on the rotisserie chicken by selling other products to customers who come to the store to buy the chicken. For example, customers who buy a rotisserie chicken are likely to also purchase other items, such as side dishes, drinks, and desserts.

In the US, customers are highly responsive to discounts and promotions, making loss leader pricing an effective way to draw them into stores and increase overall sales. On the other hand, loss leader pricing is not as common in Europe due to stricter regulations and antitrust laws. Some European countries have laws that prohibit selling products below cost, considering it as predatory pricing that could harm competition and smaller businesses.

Identifying the best combination of pricing for your retail business

Pricing is a crucial aspect of retailing, impacting sales, profits, and customer satisfaction. However, selecting the right pricing strategy mix can be challenging, as it depends on various factors like the product, target market, and competition. Making a wrong decision can cost valuable customer opportunities.

As is evident from the various strategies shared above, these can be used in multiple ways to ensure maximum sales and ROI.

To optimize pricing strategies, advanced technology like Pricing Manager by Flipkart Commerce Cloud is invaluable. By automating pricing decisions, FCC empowers businesses to make better choices and maximize profits.

More Blogs

See how retailers and brands are winning with FCC

Mastering Pricing Strategy Framework

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2025

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Everything About Price Skimming Strategy Explained

Read More

Mastering Pricing Strategy Framework

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2025

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Everything About Price Skimming Strategy Explained

Read More

Mastering Pricing Strategy Framework

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2025

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More